The mining industry, an activity involving the extraction of digital currencies like Bitcoin, is rapidly growing. Due to the significance and value of digital currencies, many individuals and companies are seeking to acquire Bitcoin. One crucial factor in Bitcoin mining is the use of modern mining devices. But the question arises: how much Bitcoin does each mining device mine annually? To answer this question, stay with us until the end of this article.

What is Bitcoin Mining?

Bitcoin mining is a process where digital currencies like Bitcoin are extracted using computers and special devices known as miners. Mining is essentially an activity used to solve complex mathematical problems called “proof-of-work algorithms.” These algorithms play a role in validating transactions and creating new blocks in the Bitcoin network.

The Bitcoin mining process works as follows: mining devices use their processing power to solve complex mathematical problems. Each time a problem is solved, a new block is added to the blockchain, and the new transactions within that block are confirmed. As a reward for solving each problem, miners receive new Bitcoins.

Due to the complexity and costs associated with equipment and electricity consumption, Bitcoin mining is performed industrially and on a large scale. Many miners join mining pools, where the processing power and resources of the miners are combined to increase the likelihood of mining a Bitcoin block. The reward for mining a block is then distributed among the pool members in proportion to the processing power they contribute.

Bitcoin mining can be viewed as a process that ensures the security of the Bitcoin network in the modern digital economy. Also, due to the limited resources and mathematical difficulty associated with Bitcoin mining, the supply of new Bitcoins is limited, controlling inflation.

Factors Influencing Bitcoin Mining Output

Several factors determine the amount of Bitcoin mined by each device annually:

1. Processing Power (Hashrate): The processing power or computational capability of mining devices on proof-of-work algorithms is a crucial determinant of Bitcoin mining speed and performance. The higher the processing power, the more capable the miner is of solving complex mathematical problems and producing more blocks.

2. Network Difficulty: The difficulty of the Bitcoin network is related to the complexity of the mathematical problems associated with mining blocks and generating new Bitcoins. The difficulty level is adjusted by the network periodically to ensure that the average time required to solve each problem remains constant. Even if the network’s processing power increases, the difficulty adjusts to maintain consistent mining times.

3. Block Reward: The reward miners receive for solving each block is determined by Bitcoin’s reward policy. Initially, this reward was 12.5 Bitcoins, which halves approximately every four years or every 210,000 blocks. Currently, the reward for each mined block is 6.25 Bitcoins. Block rewards, along with transaction fees, incentivize miners to continue mining activities.

4. Energy Costs: Bitcoin mining requires significant electricity consumption. Therefore, energy costs associated with mining operations can be a critical factor in determining miners’ profitability. Generally, mining devices with lower power consumption are more profitable in the long run.

5. Hardware Costs: Procuring and maintaining mining devices requires substantial initial investment. Hardware costs include purchasing components like ASICs (specialized circuits for Bitcoin mining), cooling equipment, cables, etc. These costs can significantly impact Bitcoin mining profitability.

6. Other Variable Costs: Other factors, such as equipment repair and maintenance, internet and communication costs, security maintenance expenses, etc., also affect Bitcoin mining profitability.

Examples of Popular and Renowned Miners in the Market

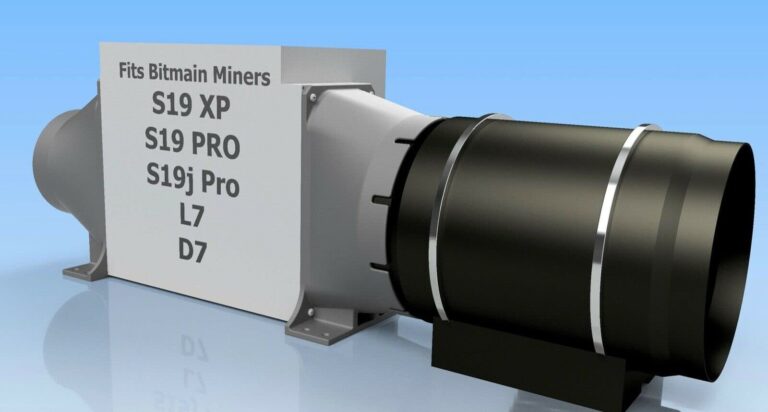

– Bitmain Antminer S19: Produced by Bitmain, these miners are among the most powerful in the market. The S series of Antminers have high processing power and can mine Bitcoin quickly. The Antminer S19 uses ASIC technology and is suitable for mining with the SHA-256 algorithm, available in various models.

– MicroBT Whatsminer M30S++: Manufactured by MicroBT, these miners are among the most powerful and up-to-date in the market. The M series Whatsminers feature high processing power, high efficiency, and lower energy consumption compared to older models. The Whatsminer M30S++ also uses ASIC technology and is suitable for mining with the SHA-256 algorithm, available in different hashrates from 100 to 112 TH/s.

How Much Bitcoin Can Each Miner Extract?

To estimate the Bitcoin mining output of each device, you need two factors: processing power (expressed in terahashes per second, or TH/s) and the device’s power consumption (expressed in watts, or W). Using these two factors, you can estimate each miner’s Bitcoin mining capability.

Suppose your mining device has a processing power of 100 terahashes per second (100 TH/s) and a power consumption of 1500 watts (1500 W). You can use this information to estimate your Bitcoin mining output as follows:

– Bitcoin Mining Power (in TH/s) = Processing Power (TH/s)

– For example:

– Bitcoin Mining Power = 100 TH/s = 100 TH/s

To calculate the electricity cost based on the device’s power consumption, you can use the following formula:

– Electricity Cost for a Unit of Time = Power Consumption (W) × Time (in hours)

Using this information, you can estimate your Bitcoin mining output and electricity costs. Note that these estimates may differ slightly from reality, and it is best to use your device and its technical specifications for more accurate calculations.

Final Thoughts

When selecting a suitable miner for Bitcoin mining, it’s crucial to consider the device’s technical specifications, processing power, power consumption, efficiency, and costs. Each mining device has its own advantages and disadvantages.

Popular miners like the Bitmain Antminer S19 and MicroBT Whatsminer M30S++ boast high processing power and efficiency, making them capable of substantial Bitcoin extraction. These devices are among the most popular in the mining industry and can mine Bitcoin at high speeds.

However, when choosing the right miner, you should also consider other factors such as electricity costs, device purchase costs, noise and heat generation, and the device’s upgradeability. Your needs and financial capacity also play a significant role in selecting the appropriate miner.

Before purchasing and using any mining device, conducting thorough research on the technical specifications, performance, and experiences of others can help you make a better decision and choose a miner that best meets your needs and conditions.